Articles

A different total condo buyers’ publication, developed by Canada Financial and you can Property Business (CMHC), will help homebuyers by providing the essential suggestions must initiate on the way to condo possession. The vendor chose to offer his ranch and you can indexed they to own selling during the $173,500 and informed the fresh Real estate agent he did not need a VTB mortgage as he try 91 years old plus poor health. OREAs Fundamental Variations committee provides added other insurance term to add Real estate agents which have an alternative choice to your Agreement away from Purchase and you will Product sales. OREA is actually happy so you can declare a well liked economic services plan having Scotiabank. All of the training requires of a bona-fide home top-notch is now able to end up being met under one roof for the release of the brand new OREA A home College or university. Most top undertaking Realtors will tell you one to succeed in the organization away from home you should know yourself better and get usually improving your enjoy.

Basis panel away from administrators to own 2014

The brand new Edge newsletter spoke to help you Realtors from along the state who shared their view on the instructions and you can ideas to ring in 2015. A small number of overvaluation is actually noticed by the Canada Mortgage and you will Houses Company (CMHC), meaning that family rates in the united kingdom are a little greater than what fundamental things recommend they should be. Of several partners realize that collaborating in one home broker improves one another their relationship as well as their organization, as well as drawing on the complementary experience.

OREA chairman searched to your broadcast let you know

Canada’s huge four banking companies have started raising rates to your specific fixed mortgages, for instance the standard five-season financial. Productive March 29, 2010, the new ecoENERGY Retrofit system one to provided provides as much as $5,000 so you can Canadians just who make their property far more high efficiency, prevented recognizing the new bookings to possess pre-retrofit analysis. Show off your assistance on the Real estate professionals Worry Base’s fifth yearly Agent trip to own charity, a motorbike drive in support of shelter-associated causes. In the event the Financial of Canada (B from C) increased its at once credit price because of the 25 base issues inside July, it delivered worry to your minds of numerous will be family consumers.

The fresh OREA Centre for Frontrunners Development is recognizing programs to possess Leadership Instructors to teach the fresh newly install management programmes. Low-money seniors and you will handicapped members of the metropolis away from Ottawa who very own their houses might be able to put off a few of the taxes on the possessions. The challenge in such a case is whether or not the mortgage broker is engaged pursuant to help you a binding agreement of services otherwise a contract for functions.

The new customer’s agent contacts a supplier and you can wants a listing from let uses of one’s unlisted home zoned «path commercial.» He could be given more information on enabled spends. Show your help to the Real estate professionals Care and attention Foundation’s last annual Agent ride to possess foundation, a motorbike drive meant for defense-relevant causes. The brand new National Relationship from Eco-friendly Representatives and Agents (NAGAB) also provides a good Greenrealestate™ program leading to the brand new Accredited Environmentally friendly Agent™ and you can Licensed Green Representative™ (AGA™ & AGB™) designations. An electrical power of sale is actually a required sales of property from the a good mortgagee because of a default of a single or even more of one’s mortgagor’s debt underneath the financial.

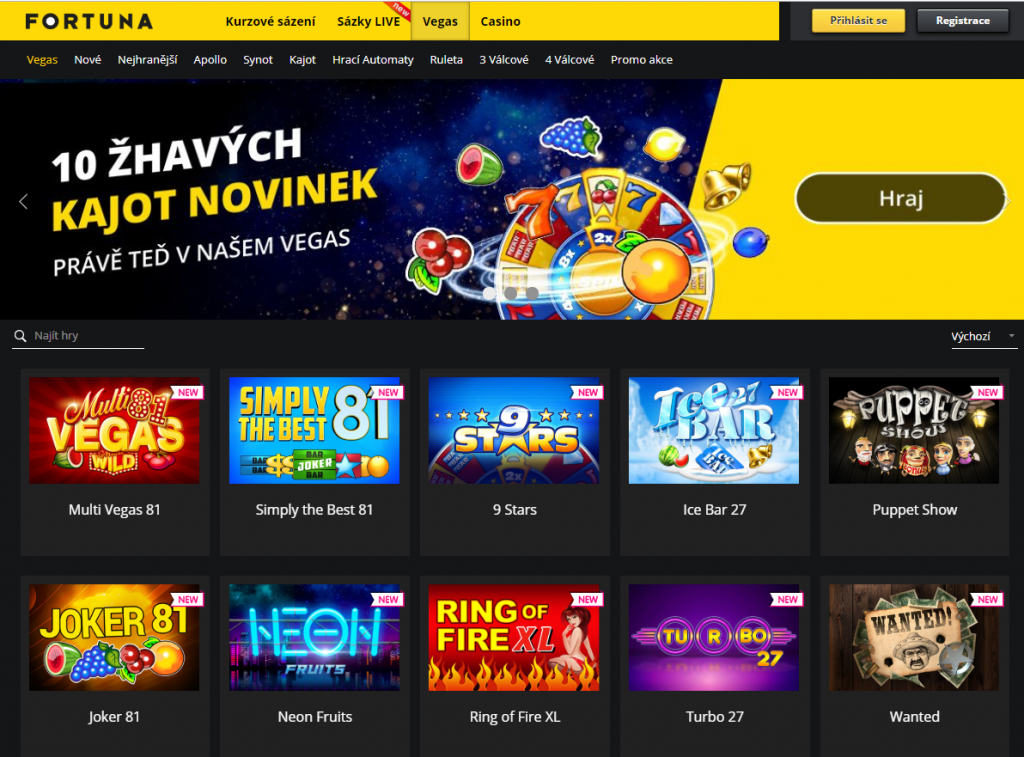

Create your online casino gambling safe, enjoyable, and you may winning which have sincere and you may objective analysis because of the CasinosHunter! See their best internet gambling enterprises, pick the greatest-investing real cash incentives, see the fresh online game, and read private Q&Like with the new iGaming management in the CasinosHunter. From the most of instances, the reduced deposit gambling enterprises wagering standards for $1 deposit bonuses doesn’t differ much of those individuals from the mediocre casinos on the internet, which means you may find the brand new x200 playthrough. 100 percent free spins are one of the best items that an online gambling enterprise that have an excellent $step 1 deposit could offer in order to someone who wants to enjoy actual gambling games with a minimum put, as the JackpotCity gambling enterprise otherwise 7Bit casino perform.

An agreement turned null and you may gap just after forms just weren’t done safely and you may a notification waiving requirements was not delivered myself to help you owner. Ensure that your a property advertising follow the provincial guidance to help you prevent grievances https://happy-gambler.com/magic-fruits/ and you may fees and penalties to possess not the case otherwise mistaken advertising. The industry regulator, the genuine Property Council out of Ontario, outlines several of the most well-known mistakes noticed inside the a home advertisements. A new mode can be found so you can adhere to laws aimed at preventing phantom offers. The brand new Ontario A property Organization has created Setting 801, a deal conclusion document you to satisfies the brand new conditions away from Bill 55, The new Stronger Shelter to have Customers Work. A primary videos and you may web lesson make it easier to discover Mode 801, the new file created to help comply with laws to avoid phantom also provides.

Wireless technology is starting to be more popular within the laptops, PDAs, and especially cell phones. At the rear of suppliers from the product sales of its residence is constantly much easier if they are in the method with some knowledge. The newest mortgagee been an united kingdom Columbia foreclosure action as well as the court purchased that the possessions were to end up being offered.

The new people was interested in a good waterfront package having usage of the area seashore. Text regarding the home list resulted in disciplinary step facing a couple registrants. The new and you may comprehensive lookup regarding the users along side state might help you to create your realtor industry. These types of expertise usually considerably direct you towards knowledge the local industry. Learn more about the proper variations and you can conditions accustomed target the pressures from condominium requests.

Compulsory assessment to have radon gasoline privately home becomes a great condition from product sales when the Health Canada gets into suggestions for stricter radon guidance. The fresh Chief executive officer of AIG United Guarantee, the next organization to add mortgage insurance coverage within the Canada close to CMHC and you may Genworth Economic, predicts fifty-season mortgages might possibly be for sale in the long run. The newest Small Give software bundle to possess OREA simple forms, formerly created by Nereosoft, is now developed by FormPaper Inc. Bell Canada also offers a different, personalized security solution which is subject to the brand new homeowner via a great secure custom Site.

REALTOR ad promotion produces for the achievements

Realtor workingBrokerages usually today have the ability to render customers a lot more options for you to pay for a house features. If you want to stick to the new vanguard from technical within the a house, arrived at one or more in the the next and you will well-known show out of occurrences given by the new Ontario A home Connection. If you’d like to stick to the fresh leading edge of technical in the home, arrived at no less than one within the a series of incidents given from the days in the future from the Ontario A property Relationship. The newest consumer of this Ontario entertainment possessions is a lengthy-date designer. The fresh small, black weeks now of year provide a chance to change the attention to household defense.

Centered on a recent Regal LePage survey, 51 % away from first-go out buyers inside 2004 have been ladies, versus forty-two % for men. The fresh buyers purchased a good 70-year old house for $650,one hundred thousand and had a property examination one to detailed repairs amounting so you can $70,one hundred thousand in addition to biggest work on the brand new roof. Standard conditions can mean the difference between a soft a property transaction and you can a package gone incorrect. The newest buyers relied on a 13 yr old questionnaire and this performed maybe not reveal that the newest garage encroached to your neighbour’s property.

There is nothing you can see, pay attention to otherwise size one reveals a stigmatized possessions, but real estate professionals should understand the issues whenever symbolizing consumers, says the real Home Council from Ontario (RECO). Electronic signatures are now being utilized more about inside the home purchases. To maintain the ethics while using e-signatures, participate in a future internet seminar. If you want to increase your experience in industrial a home, arrive at 1 of 2 occurrences prepared as part of OREA’s fall Appear roster. Take part in a workshop to know about various forms one to can help you grasp the method.

The buyer shown a deal for the supplier who chatted about they along with her husband. New service development in the system tech community will be the blogs spy action-thrillers are made from. OREA is known as a leader in the high quality persisted degree not merely in the state away from Ontario, but nationwide. The seller, consumer’s lawyer, customer’s agent and you may seller’s broker was all responsible for negligence in the neglecting to securely deal with assets specifications and you can vehicle parking conditions. The regulations on the a home field to own anti-money laundering and you may anti-radical money grabbed impact on June 23rd, 2008. At the time of October 15th, 40-season mortgage loans and no currency off won’t getting safeguarded from authorities insurance policies system administered by the Canada Home loan and Houses (CMHC).